What triggers a liquidation?

A liquidation is triggered when your account equity (remaining margin) falls below the maintenance margin requirement for your open position. Key concepts:- Initial Margin: The collateral you provide when opening a position.

- Maintenance Margin: The minimum required collateral to keep the position open.

- Liquidation Price: The price at which your position will be force-closed to prevent further loss.

- At 40x leverage, the maintenance margin is roughly 1.25% of your position size.

- At 3x leverage, it’s around 16.7%.

What happens during a liquidation?

When a liquidation is triggered, HyperETH attempts to close your position at the best available price through a market order. If this is successful:- Your position is closed

- Any remaining margin is returned to your account

- You may lose your entire position margin

- However, HyperETH’s system ensures your account will not go negative.

Backstop liquidations

If the market fails to fully close your position and your equity falls below two-thirds of the maintenance margin, HyperETH triggers a backstop liquidation using the Liquidator Vault. This affects you depending on the margin mode:- Cross Margin: All funds and positions in your Perps account are transferred to the Liquidator Vault.

If you have no isolated positions, your account equity becomes zero.

- Isolated Margin: Only the specific isolated position and its assigned margin are liquidated.

Other positions and funds remain unaffected.

Tips on avoiding liquidations

- Use lower leverage to reduce the liquidation risk margin

- Monitor the margin ratio and keep extra collateral in your account to stay above the maintenance margin

- Set stop loss (SL) orders to automatically exit positions before liquidation triggers.

- Understand margin modes effectively, using Isolated for single-position risk, or **Cross **for portfolio-level exposure

Viewing liquidations on HyperETH

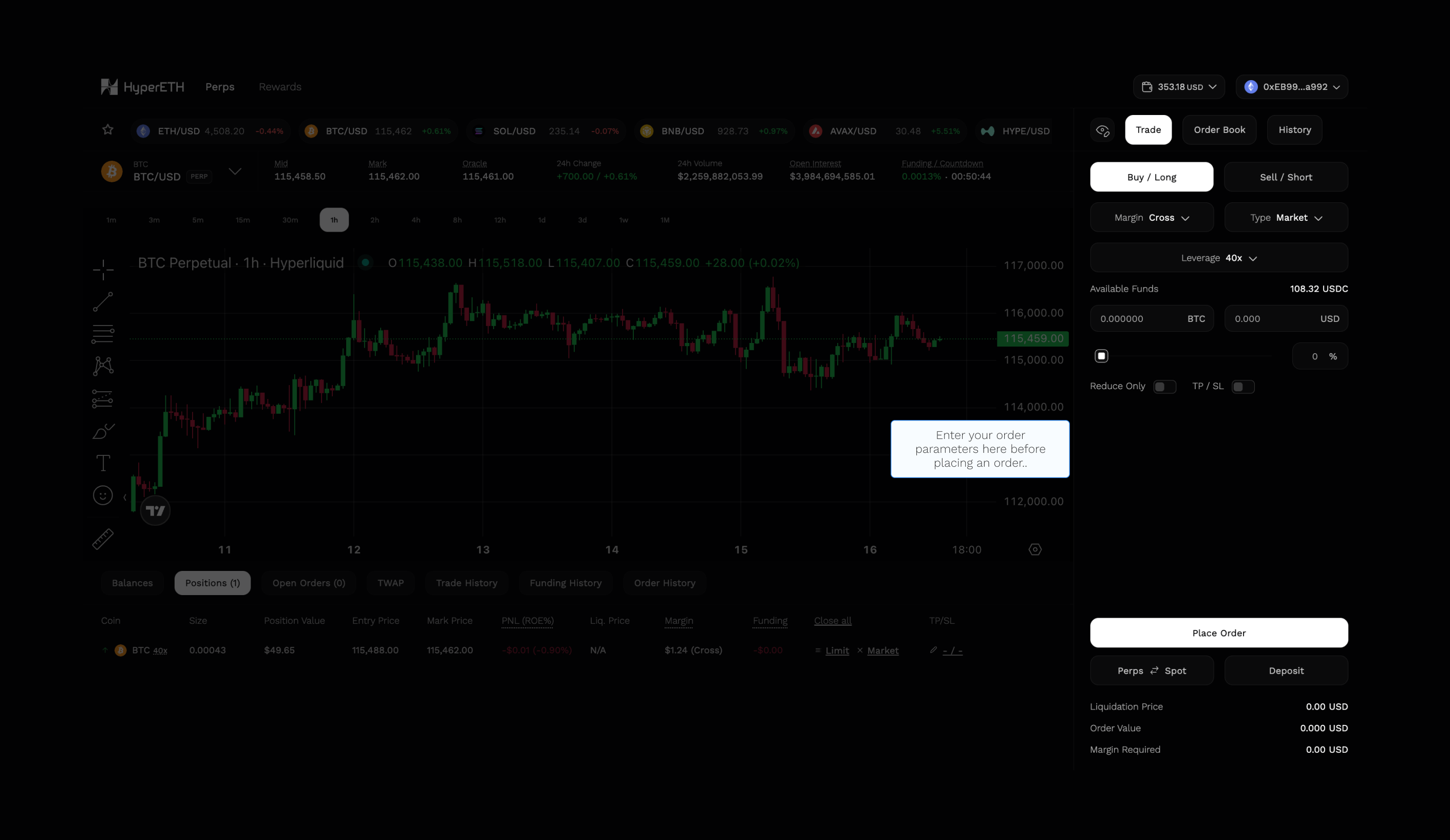

Under the Positions tab, the Liquidation Price for each position will be displayed.