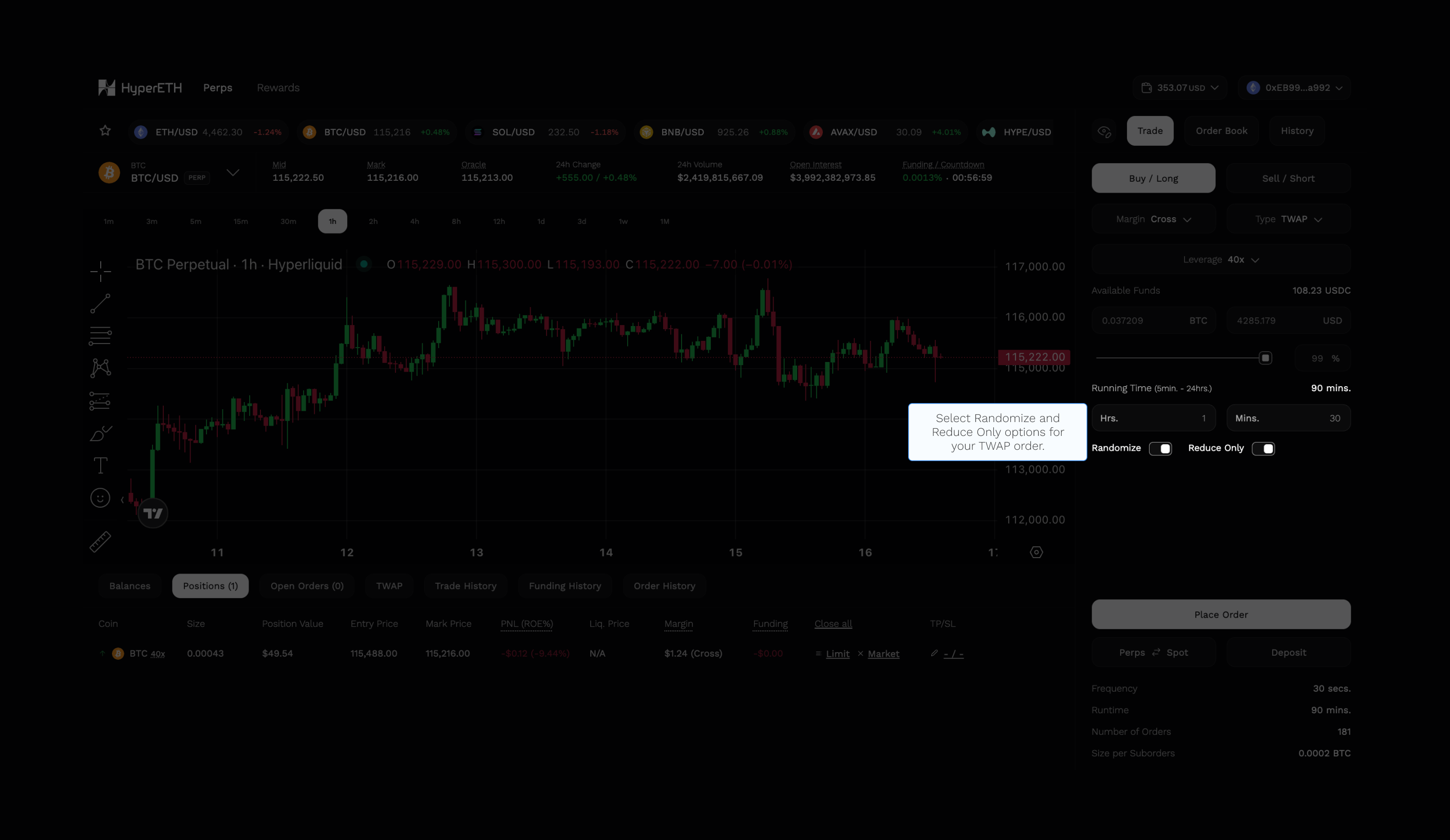

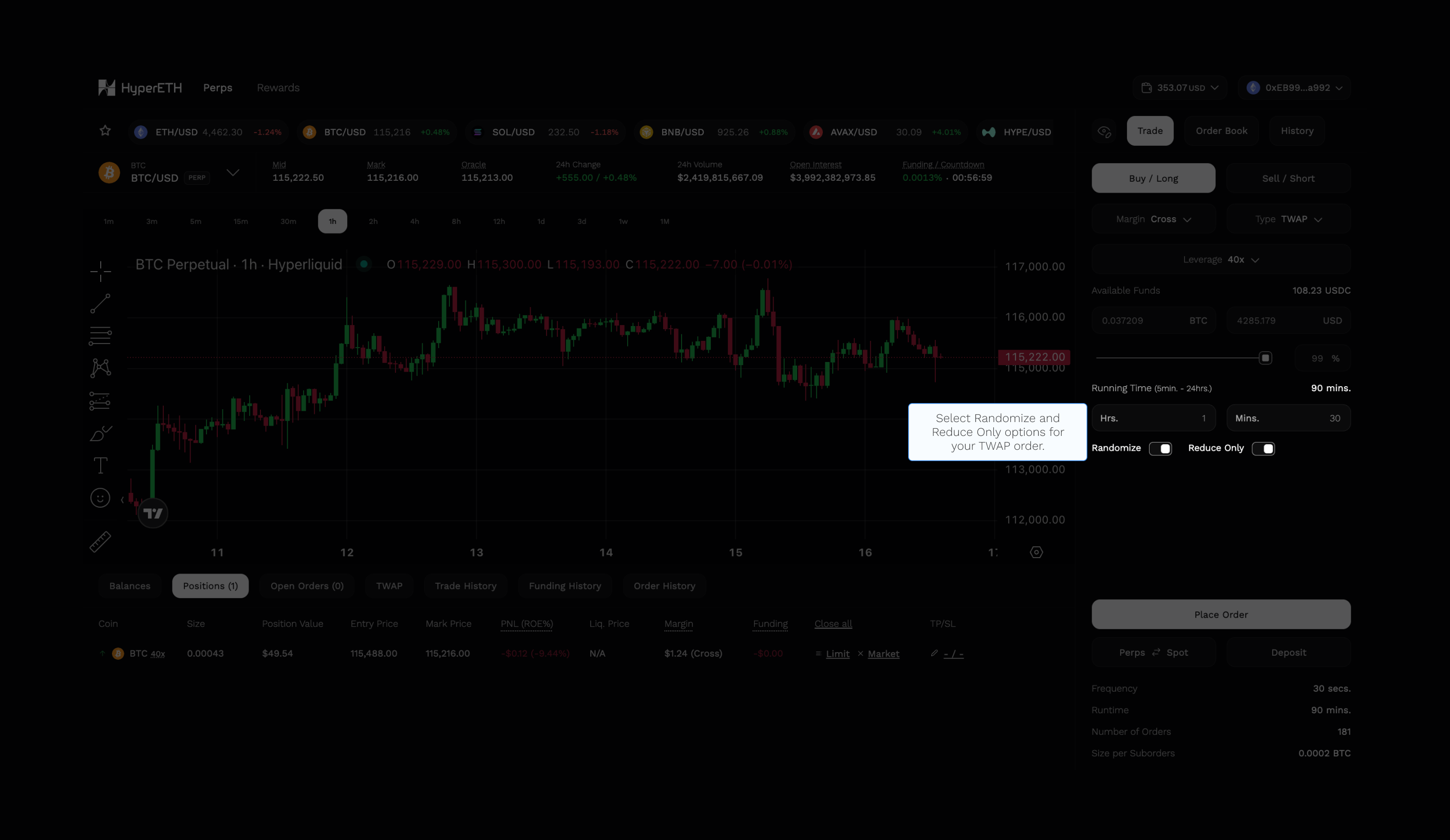

TWAP stands for Time-Weighted Average Price: a smart order execution strategy that splits a large order into smaller, evenly spaced trades over a set period of time.

Instead of placing one large order that could move the market or suffer from slippage, TWAP helps users blend into the order flow, achieving smoother and more discreet execution.

TWAP is ideal for large trades, illiquid markets, or when minimizing market impact is more important than speed.

| Parameter | Description |

|---|

| Order Size | Total amount to buy or sell (e.g., 100 ETH) |

| Duration | How long the order should be executed (e.g., 1 hour) |

| Interval | How often suborders are placed (HyperETH uses a fixed 30-second interval) |

Suborders are placed as market orders, each with a maximum slippage cap of 3%. If earlier suborders don’t fill completely (because of wide spread, low liquidity, etc.), later ones may increase in size (up to 3× the standard size) to stay on pace.

Suborders are placed as market orders, each with a maximum slippage cap of 3%. If earlier suborders don’t fill completely (because of wide spread, low liquidity, etc.), later ones may increase in size (up to 3× the standard size) to stay on pace.

TWAP options

When enabled:

- The TWAP will only reduce your current Perps position.

- If you have no position, no suborders will be placed.

- Prevents accidental position flips,e.g. closing a long and unintentionally opening a short.

When enabled:

- The bot slightly varies the size and timing of each suborder.

- Makes your TWAP execution less predictable, helping avoid detection by algorithms or front-running bots.

Both options can be selected when placing a TWAP order.